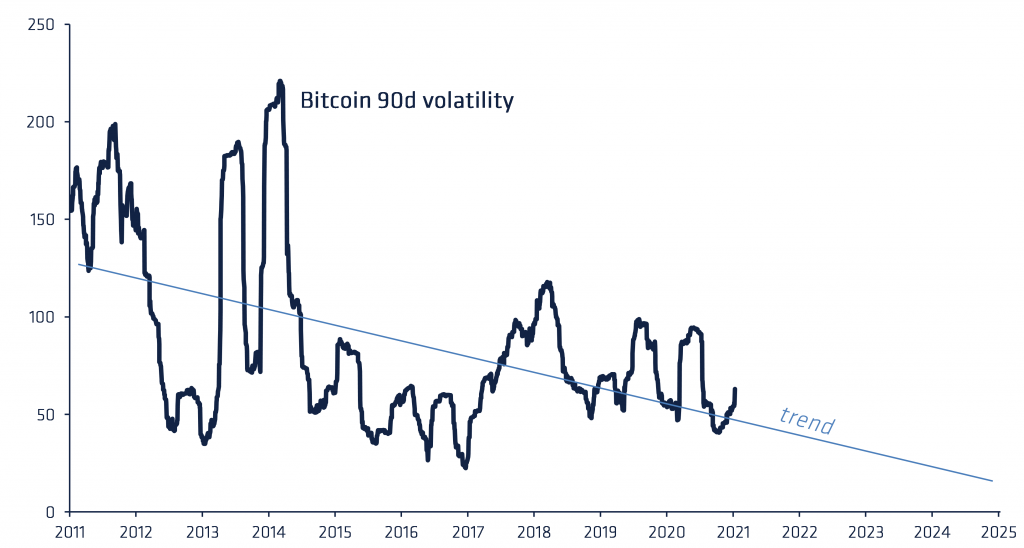

Bitcoin, and more broadly digital assets, represent the birth of a new asset class – something rarely witnessed. Consequently it’s hard to categorize their volatility. Long-term trends suggest it will decline to levels similar to those seen in other asset classes by approximately 2025.

Due to the broad-based uncertainty surrounding anything that is new to the world, volatility should be expected. While not a perfect analogy, one could compare bitcoin’s volatility to the emergence of a new company, this is similar in that it is a new concept with an unproven track record.

The birth of a new asset class

When Twitter was first listed it’s 90-day volatility was 130%. As its use has (arguably) become clearer, so has its volatility declined. But that is where the similarities end. Bitcoin is infinitely more complex than Twitter in its structure, it is a global asset that is accessible in what initially were completely unregulated new exchanges that helped facilitate price discovery. Being such a new asset with new exchanges coupled with a complex set of expected uses from investors, it becomes apparent as to why its volatility reached levels as high as 200% in the years following its inception.

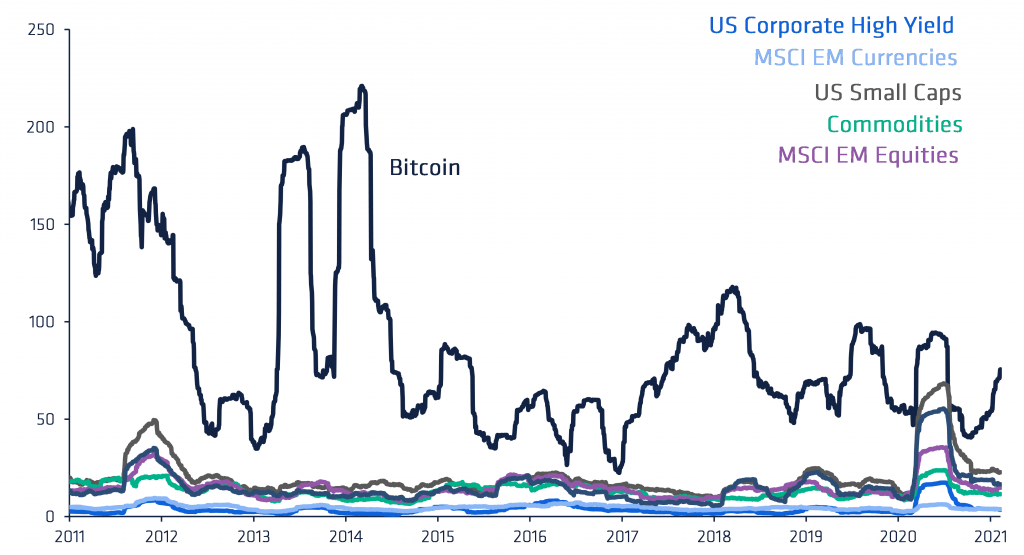

90d Trailing Volatility (Price) on select asset classes

Investors commonly, and validly, criticise bitcoin for its high volatility. At present, its 90 day trailing volatility sits at a heady 71%, well above other perceived risky assets such as US small caps at 23% or MSCI Emerging Markets at 15%. However, we do not believe bitcoin volatility is likely to remain at these levels in perpetuity.

Volatility will likely decline as Bitcoin matures

We believe that as the Bitcoin network matures, including the financial infrastructure such as exchanges and liquidity providers that have grown up alongside it, the volatility of bitcoin the asset will decline. More recent acceptance from traditional exchanges such as the Chicago Mercantile Exchange, the use of ETPs and custody in traditional banks are also likely to help this trend by deepening the liquidity in bitcoin markets.

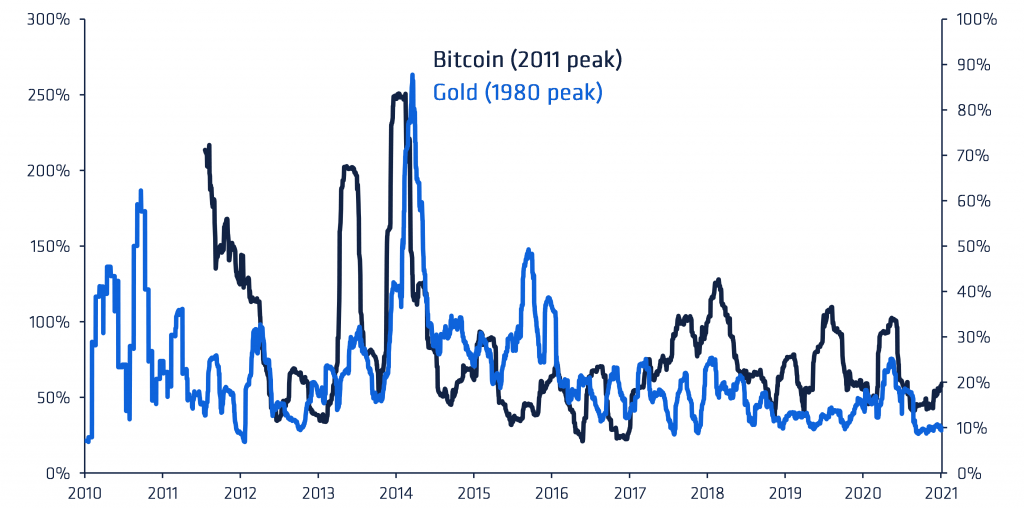

Bitcoin volatility (90 day) versus Gold late 20th century

We have seen gold take a similar path to bitcoin in the late 20th century. After the Executive Order 6102, that banned the ownership of gold was lifted in the US in 1975, gold began to be traded, used as an inflation hedge, and generally incorporated into modern portfolios. Over this period, its volatility fluctuated from 10% to a peak of 90% on a 90 day basis in 1980, but as its identity as a modern portfolio a store of value grew, so its volatility declined.

The market conditions in which gold began to be used in a modern portfolio were quite different to today. There was no algorithmic or high frequency trading and much of the trading was done via open outcry trading floors. If gold started its life as a modern portfolio asset today, its volatility would most likely be much higher than it was in 1980 and likely face similar criticisms that bitcoin does today.

Bitcoin – 90d Trailing Volatility

We are encouraged by the continued declining trend in volatility. Despite the recent volatility increases this has not impinged on its downwards trajectory, with current trends suggesting bitcoin volatility will fall to levels seen in other assets classes by 2025.

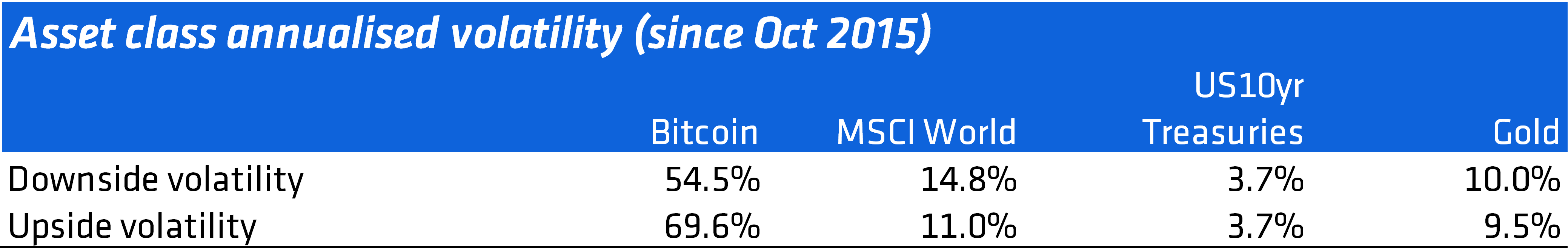

Upside and downside volatility

There are some oddities regarding Bitcoin’s volatility, it tends to have greater volatility when prices are rising (upside volatility) rather than when prices are falling. This is unusual as most assets tend to behave in the opposite manner.

The Sharpe ratio uses a broad measure of volatility in its calculation but is crude as it does not differentiate between upside and downside volatility. Investors may not wish to penalise for upside volatility as it is associated with a more positive outlook for the asset being measured. The Sortino ratio attempts to correct for this by using only downside volatility (Rollinger and Hoffman) when calculating risk adjusted returns.

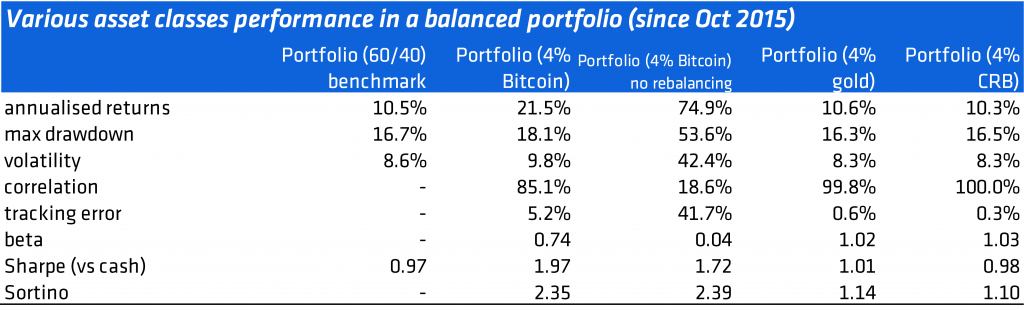

To test how bitcoin would help or hinder a portfolio we created a database of daily returns starting from 2015 when it was first financialised (available as an ETP). We created a traditional balanced portfolio with 60% equities and 40% bonds and then added a notional 4% bitcoin, detracting from both equities and bonds equally (see our more detailed work here).

In this portfolio we find that the Sortino ratio is considerably higher at 2.3 compared to the Sharpe ratio at 1.9, implying that when upside volatility is removed, risk adjusted returns improve. It highlights that the use of the Sharpe ratio to measure portfolio risk adjusted returns unfairly penalises bitcoin relative to other asset classes.

How to deal with Bitcoin volatility in a portfolio

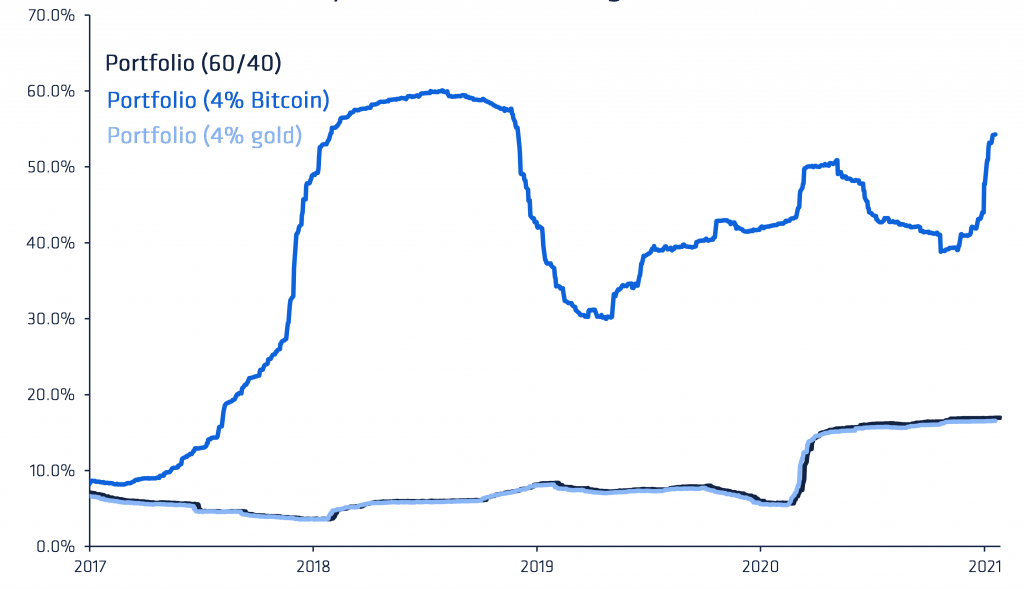

As bitcoin is an asset in its early growth phase, most investors would allow its portfolio weight to drift from its original weight to allow for price appreciation. In this scenario we find that a portfolio with 4% bitcoin (as detailed in table above) would push volatility to 41%, well above the benchmark 9.4%. This is way above the risk tolerance levels of most fund managers despite the significant benefits to annualised returns.

Rebalancing the bitcoin weighting along with the other portfolio constituents on a quarterly basis, despite its potential hindrance on enhancing returns, helps moderate the volatility problem. Looking at how volatility has evolved over time within a portfolio, during the price fall in early 2018, a 4% bitcoin allocation at times increased volatility by nearly 450 basis points. While over the whole time period it has increased volatility by 120 basis points when employing a quarterly rebalancing strategy.

12m Trailing Volatility standard 60/40 portfolio – no rebalancing

Rebalancing helps push volatility well below the levels witnessed in a portfolio where the bitcoin weight is simply allowed to drift, and likely acceptable to most fund managers. We have experimented with differing rebalancing schedules and found similar results indicating that a regular rebalancing schedule is a helpful tool in mitigating volatility (see our more detailed work here).

Our analysis suggests employing a regular portfolio rebalancing strategy, as some professional investors are already doing, is an effective strategy to help reduce volatility in a portfolio. It has also helped improve risk-adjusted returns and significantly reduce maximum drawdown. We expect the downwards trajectory in volatility for bitcoin and other digital assets to continue as this exciting new asset class matures. Regardless, when investing in bitcoin, we continue to see volatility as the price of opportunity.

*Originally posted at CVJ.CH